Introduction

When it comes to running a successful barber shop, ensuring the safety and security of your business is paramount. One crucial aspect of this is having the right insurance coverage in place.

In this article, we’ll explore the world of insurance for barbers and introduce you to Next Insurance, a leading provider of tailored insurance solutions for barbers.

Whether you’re a seasoned barber or just starting your own shop, read on to discover the best insurance options that will safeguard your business.

Understanding the Barbering Industry

The Unique Risks Barber Shops Face

Barber shops are unique in many ways. They are bustling hubs of activity, with sharp tools and busy professionals working near clients. This environment poses certain risks that other businesses don’t typically encounter. Understanding these risks is the first step in choosing the best insurance for your barber shop.

The Importance of Insurance

Insurance provides a safety net for barbers in case of unforeseen events. From accidents involving clients to property damage and equipment theft, the right insurance coverage can mean the difference between financial stability and bankruptcy.

Types of Insurance Coverage for Barbers

1. General Liability Insurance (GLI)

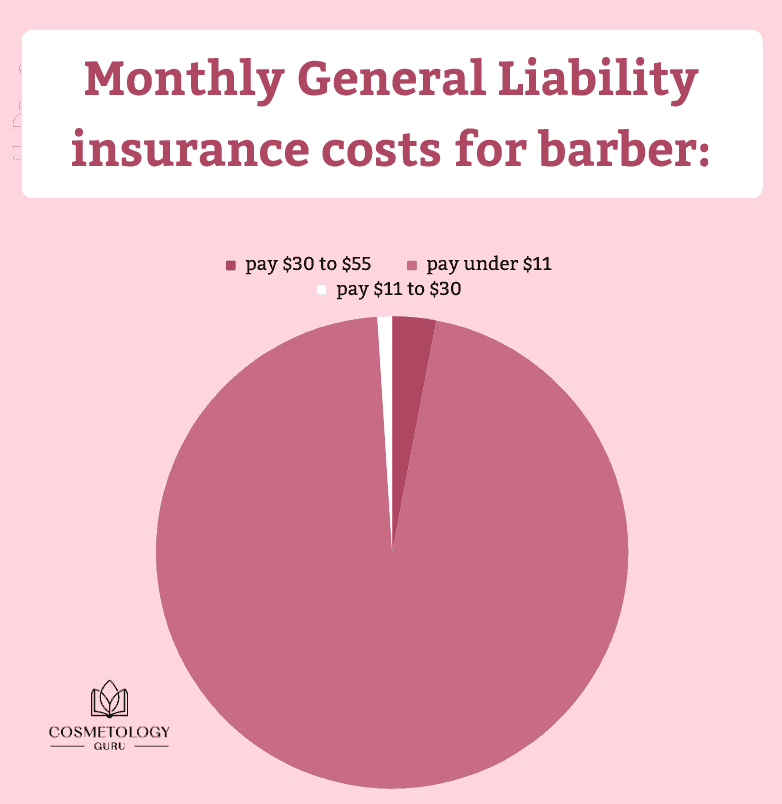

General Liability Insurance is a must-have for barbers. It covers bodily injury and property damage claims, including legal fees and medical expenses. This type of insurance protects you if a client slips and falls in your shop or if your services lead to unexpected issues. General liability insurance costs 96% of our customers $11 on average per month.

2. Professional Liability Insurance

Also known as Errors and Omissions Insurance, this coverage is essential for barbers. It safeguards you against claims of negligence or mistakes in your work. Whether it’s a haircut gone wrong or an unsatisfied customer, professional liability insurance has you covered.

3. Business Owner’s Policy (BOP)

A Business Owner’s Policy combines general liability insurance with property insurance. It protects your shop’s physical assets, such as your chairs, mirrors, and styling tools. In case of theft, fire, or vandalism, your investment is secure.

4. Workers’ Compensation Insurance

If you have employees, workers’ compensation insurance is mandatory in most states. It covers medical expenses and lost wages for employees injured on the job. It’s a crucial component of responsible business ownership.

Why Choose Next Insurance?

Tailored Coverage

Next Insurance understands the specific needs of barbers. They offer customized insurance packages that cater to the unique risks of the industry. With Next Insurance, you can be confident that your coverage is designed to address your shop’s vulnerabilities.

Affordability

Running a barber shop comes with its share of expenses. Next Insurance offers competitive rates, allowing you to protect your business without breaking the bank. Their flexible payment options make it easy to fit insurance into your budget.

Seamless Experience

Next Insurance provides an online platform that simplifies the insurance process. You can get a quote, purchase coverage, and manage your policy—all from the convenience of your computer or mobile device. No more dealing with cumbersome paperwork or waiting on hold with insurance agents.

Conclusion

Choosing the best insurance for your barber shop is a crucial decision that can protect your livelihood in times of uncertainty. With the unique risks involved in the barbering industry, it’s essential to have comprehensive coverage. Next Insurance offers tailored solutions, affordability, and a seamless experience, making them an excellent choice for barbers looking to safeguard their businesses.

Frequently Asked Questions (FAQs)

1. What is the cost of barber insurance with Next Insurance?

The cost of insurance with Next Insurance varies depending on factors such as the size of your shop, location, and the coverage you choose. You can easily get a personalized quote on their website.

2. Is workers’ compensation insurance mandatory for all barber shops?

In most states, workers’ compensation insurance is mandatory if you have employees. However, requirements may vary, so it’s essential to check your local regulations.

3. Can Next Insurance customize coverage for my unique barber shop?

Yes, Next Insurance offers tailored coverage options to meet the specific needs of your barber shop. You can choose the coverage that best suits your business.

4. How do I file a claim with Next Insurance?

Filing a claim with Next Insurance is a straightforward process. You can initiate a claim through their online portal or by contacting their customer support team for assistance.

5. Is Next Insurance available in all states?

Next Insurance operates in many states across the United States. To check if they provide coverage in your area, visit their website or contact their customer service.

In conclusion, protecting your barber shop with the right insurance is a smart business move. Next Insurance offers comprehensive coverage tailored to the unique needs of barbers, ensuring your peace of mind as you focus on providing top-notch services to your clients.